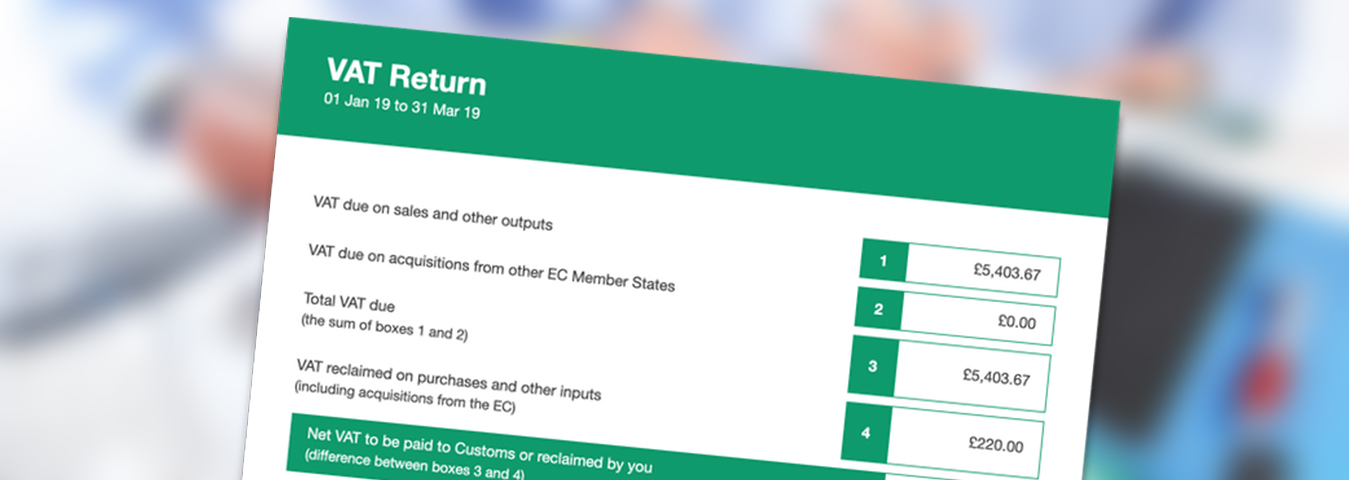

VAT Return

DSK Associates will advise on best practice for record keeping as well as Minimizing Vat Liabilities, we offer

- VAT returns and Digital filing

- Advice and help with various retail schemes, and the flat rate scheme

- Annual accounting, Cash Accounting

- VAT health checks

If you have the bookkeeping package then it is relevantly quick to prepare HMRC VAT return form and send for your approval , before submitting to HMRC.

For other clients, we need to transfer the data provided including sale / purchases/ bank records to our software and then go through any queries before we can prepare final return for approval.